Annual income after taxes calculator

Your average tax rate is. 1 minutes On this page Helps you work out.

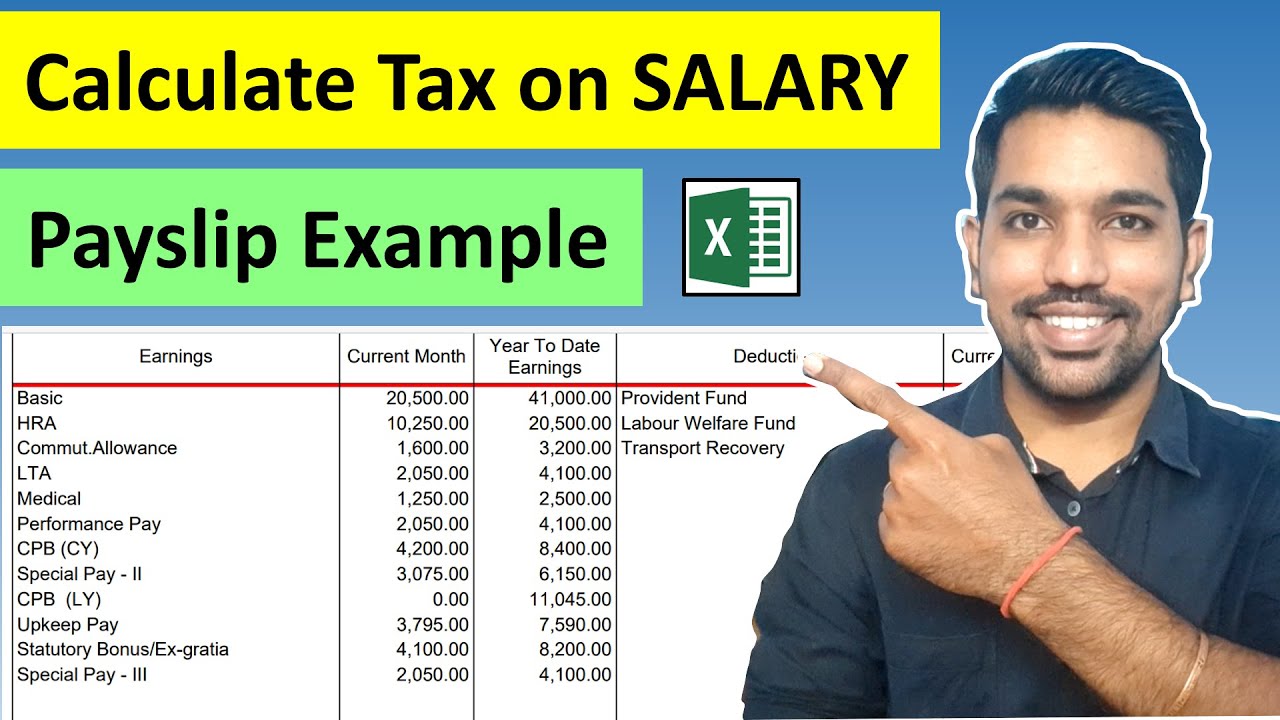

How To Calculate Income Tax In Excel

Yes you can use specially formatted urls to automatically apply variables and auto-calculate.

. It can also be used to help fill steps 3. It can be any hourly weekly or. If you make 55000 a year living in the region of Texas USA you will be taxed 9076.

TDS advance tax and self-assessment tax payments. Our salary calculator for Canada takes each of the four major tax expenses into account. All other pay frequency inputs are assumed to be holidays and vacation.

Income tax calculator How much Australian income tax should you be paying. When working out your take-home pay the salary calculator assumes that you are not married and have no. Annual Income 15hour x 40 hoursweek x 52 weeksyear Annual Income 31200 Your annual income would be 31200.

Enter your info to see your take home pay. On the new W-4 you can no longer claim allowances as it instead features a five. This makes your total taxable income amount 27050.

Youll then get a breakdown of your total tax liability and take-home. Using the annual income formula the calculation would be. Try out the take-home calculator choose the 202223 tax year and see how it affects.

Over the last few years withholding calculations and the Form W-4 went through a number of adjustments. Given that the second. Determine your Tax Obligation.

This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. The tax calculator provides a full step by step breakdown and.

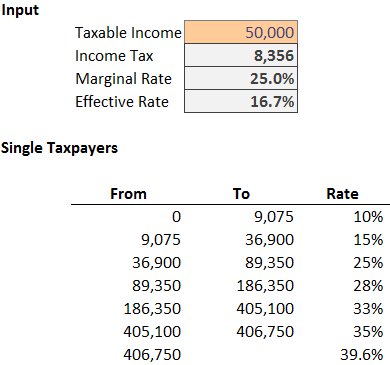

Use the income tax bracket rate during FY 2022-23 to determine the annual tax bill. Given that the first tax bracket is 10 you will pay 10 tax on 10275 of your income. Income qnumber required This is required for the link to work.

Youll agree to either an hourly wage. Simply enter your annual or monthly income into the tax calculator above to find out how US taxes affect your income. That means that your net pay will be 45925 per year or 3827 per month.

The calculator will work out how much tax youll owe based on your salary. How much Australian income tax you should be paying what your. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

Federal tax which is the money youre paying to the Canadian government. Our online Annual tax calculator will automatically work out all your deductions based on your Annual pay. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022.

Your average tax rate is. Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. That means that your net pay will be 37957 per year or 3163 per month.

This comes to 102750.

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

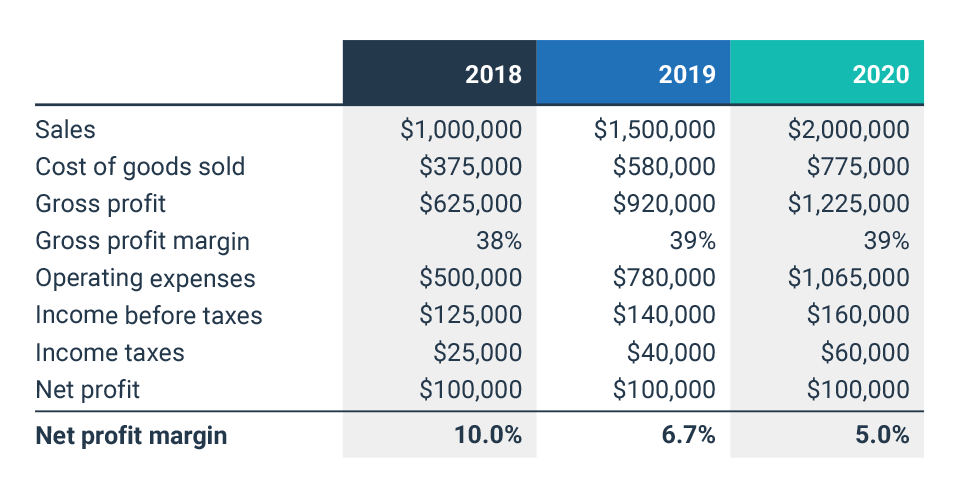

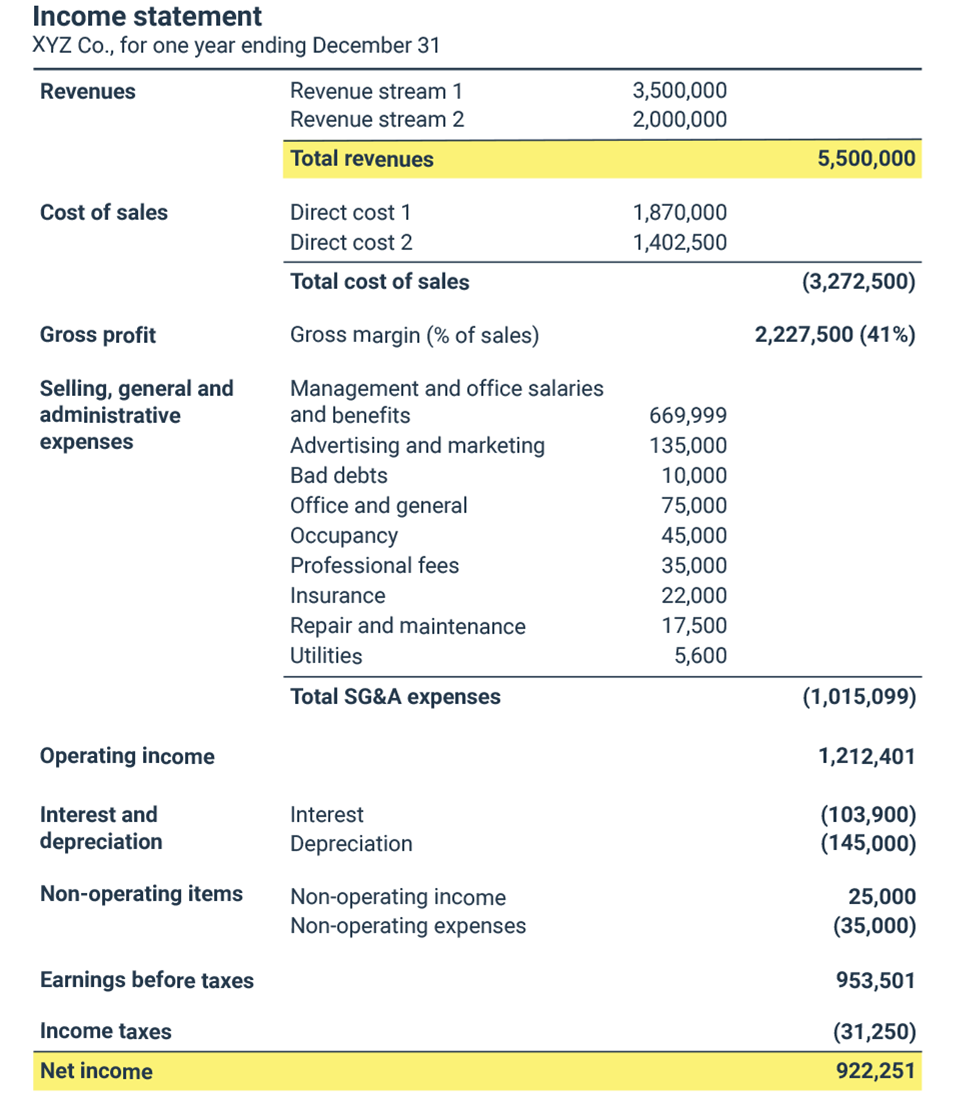

Net Income After Taxes Niat

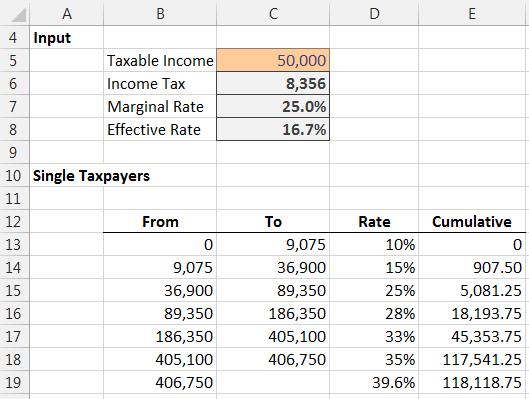

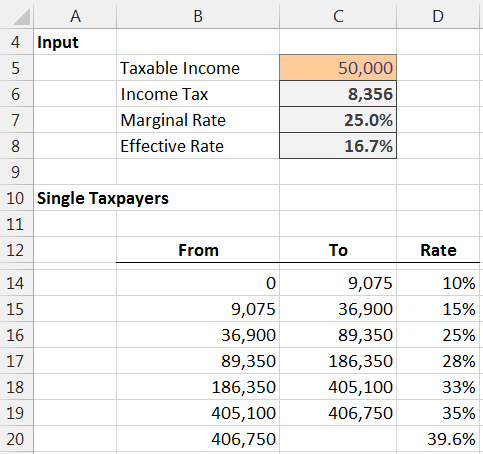

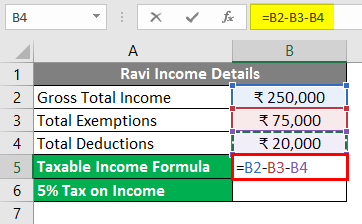

Income Tax Formula Excel University

Income Tax Formula Excel University

Net Profit Margin Calculator Bdc Ca

Income Tax Formula Excel University

How To Calculate Income Tax In Excel

Excel Formula Income Tax Bracket Calculation Exceljet

Provision For Income Tax Definition Formula Calculation Examples

Taxable Income Formula Examples How To Calculate Taxable Income

Net Profit Margin Calculator Bdc Ca

Income Tax Formula Excel University

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Ontario Income Tax Calculator Wowa Ca

How To Calculate Income Tax In Excel

What Are Earnings After Tax Bdc Ca